350 Fifth Avenue, 21st Floor

Dear

Stockholder: YouStockholders:

We are cordially invitedpleased to invite you to attend Shutterstock, Inc.'s 2014our 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) to be held on Tuesday, June 7, 2016 at the10:00 a.m., local time, at our principal executive offices of Shutterstock, Inc.located at 350 Fifth Avenue, 21st Floor, New York, New York 10118.

Details regarding admission to the meeting and the business to be conducted are described in this proxy statement and in the Notice of Internet Availability of Proxy Materials (the “Notice”) you received in the mail if you held shares as of April 20, 2016. We have also made available a copy of our 2015 Annual Report to Stockholders (the “2015 Annual Report”) with this proxy statement. We encourage you to read our 2015 Annual Report. It includes our audited financial statements and provides information about our business.

Your vote is important. Whether or not you plan to attend the 2016 Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, as well as by telephone, or, if you requested to receive or received printed proxy materials, by mailing a proxy or voting instruction form. Please review the instructions on each of your voting options described in this proxy statement, the accompanying proxy card, or the Notice you received in the mail.

Also, please let us know if you plan to attend our 2016 Annual Meeting by marking the appropriate box on the enclosed proxy card, if you requested to receive or received printed proxy materials, or, if you vote by telephone or over the Internet, by indicating your plans when prompted.

Thank you for your ongoing support of, and continued interest in, Shutterstock. We look forward to seeing you at our 2016 Annual Meeting.

|

| | |

| | Jonathan Oringer Founder, Chief Executive Officer and Chairman of the Board |

Shutterstock, Inc.

350 Fifth Avenue, 21st Floor

New York, New York 10118

April 28, 2016

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 7, 2016

Shutterstock, Inc. will hold its 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) at its principal executive offices, located at 350 Fifth Avenue, 21st Floor, New York, New York 10118, on Thursday,Tuesday, June 12, 20147, 2016 at 10:00 a.m. (Eastern Daylight Time)., local time.

The

Secretary's formal notice of the meeting and the Proxy Statement appear on the following pages and describe the matters to be acted upon at the Annual Meeting. You also will have the opportunity to hear what has happened in our business in the past year. We hope that you can join us. However, whether or not you plan to be there, please vote your shares as soon as possible so that your vote will be counted.

| | |

| | Sincerely, |

|

|

/s/ JONATHAN ORINGER |

| | Jonathan Oringer

Chairman of the Board

|

Table of Contents

Shutterstock, Inc.

350 Fifth Avenue, 21st Floor

New York, New York 10118

April 28, 2014

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Shutterstock, Inc. will hold its Annual Meeting of Stockholders at its offices, located at 350 Fifth Avenue, New York, New York 10118, on Thursday, June 12, 2014 at 10:00 a.m. (Eastern Daylight Time).

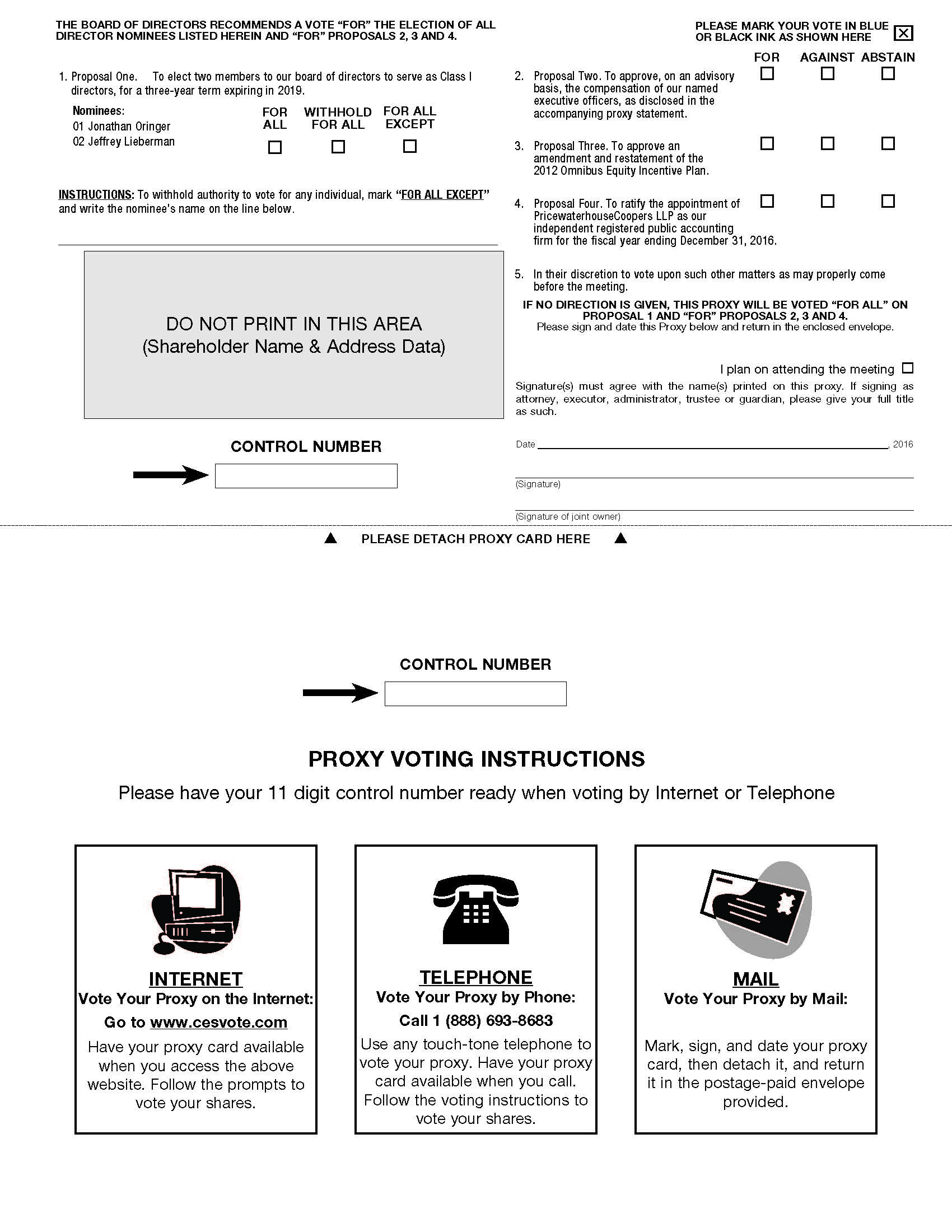

This2016 Annual Meeting is being held for the following purposes:

| |

| 1. | to elect the two nominees for director named in this proxy statement, each to serve as a Class I director for a three‑year term expiring at the 2019 Annual Meeting of Stockholders; |

| |

| 2. | to approve, on an advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement; |

| |

| 3. | to approve an amendment and restatement of the 2012 Omnibus Equity Incentive Plan; |

| |

| 4. | to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

| |

| 5. | to transact such other business that is properly presented at the 2016 Annual Meeting and any adjournments or postponements thereof. |

You can find more information, including the nominees for director, in the attached proxy statement. Our Board of Directors recommends that you vote in favor of each of proposals one, two, directors to serve untilthree, and four as outlined in the 2017 Annual Meeting of Stockholders;attached proxy statement.

•to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2014; and

•to transact any other business that properly comes before the Annual Meeting. The

Our Board of Directors has selected April

17, 201420, 2016 as the record date for determining stockholders entitled to vote at the

2016 Annual Meeting. A list of stockholders as of that date will be available for inspection

at the 2016 Annual Meeting and during ordinary business hours at our principal executive offices

located at 350 Fifth Avenue, 21st Floor, New York, New York 10118 for ten days before the

2016 Annual Meeting.

Except for those

We have elected to provide our stockholders that have already requested printed copies ofwith access to our proxy materials we are furnishingover the Internet under the Securities and Exchange Commission’s “notice and access” rules. We believe that providing our proxy materials for thisover the Internet increases the ability of our stockholders to access the information they need, while reducing the environmental impact of our 2016 Annual Meeting to you through the Internet. OnMeeting. Accordingly, on or about April 30, 2014,28, 2016, we intend to mailwill begin mailing a Notice of Internet Availability of Proxy Materials (the "Notice"“Notice”) to all stockholders of record on our books at the close of business on April 20, 2016, the record date. If you received a Notice by mail, you will not receive a printed copy of the proxy materials, unless you specifically request one. Instead, the Notice instructs you on how to access and review all of the important information contained in our Proxy Statement and in our Annual Report on Form 10-Kdate for the fiscal year ended December 31, 2013 (which we posted on the Internet on February 28, 2014), as well as how to submit your2016 Annual Meeting, and will post our proxy over the Internet. We believe that mailing the Notice and posting other materials on the Internet allow us to provide you withwebsite referenced in the information you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. If you receivedNotice. As more fully described in the Notice, and would still likestockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed copyset of our proxy materials,materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail, or electronically by email, on an ongoing basis.

If you are a stockholder of record, you may vote in one of the following ways:

Vote over the Internet, by going to www.cesvote.com (have your Notice or proxy card in hand when you access the website);

Vote by Telephone, by calling the toll-free number 1 (888) 693-8683 (have your Notice or proxy card in hand when you call);

Vote by Mail, if you received (or requested and received) a printed copy of the proxy materials, by any ofreturning the following methods: throughenclosed proxy card (signed and dated) in the Internetenvelope provided; or

Vote in person atwww.proxyvote.com; by telephone at 1-800-579-1639; or by sending an e-mail tosendmaterial@proxyvote.com the 2016 Annual Meeting.

Your vote is very important. Whether or not you plan to attend the 2016 Annual Meeting, pleasewe encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, as soon as possible in accordance withplease refer to the instructions providedon the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled “Questions and Answers About the Proxy Materials and the 2016 Annual Meeting” beginning on page 2 of this proxy statement or, if you requested to receive or received printed proxy materials, the enclosed proxy card.

If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to ensure that your vote is counted at the Annual Meeting.be voted.

|

| | |

| | |

| | | By Order of the Board of Directors, |

|

|

/s/ TIMOTHY E. BIXBY |

|

|

Timothy E. Bixby

Laurie Harrison Vice President, General Counsel and Secretary |

| | |

| |

| | Page | |

|---|

GENERAL INFORMATION

| | | 1 | Page |

| |

| | | | |

Our Board; Selection of Nominees | | | | |

Nominees for Election for a Three-Year Term Ending withExpiring at the 2019 Annual Meeting | |

| |

| | | | |

Recommendation of the Board

| | | 7 | |

Directors Continuing in Office Until the 20152018 Annual Meeting | | | | |

Directors Continuing in Office Until the 2016 Annual Meeting

| | | 9 | |

Governance of the Corporation | | | | |

PROPOSAL TWO—ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

| |

| |

| |

| |

| |

| | | | |

Selection of the Accounting Firm | | | | |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | | | | |

Principal Accountant Fees and Services | | | | |

Recommendation of the Board | | | | |

| | | | |

| | | | |

Beneficial Ownership of Certain Stockholders, Directors and Executive Officers | | | | |

Section 16(a) Beneficial Ownership Reporting Compliance | | | | |

COMPENSATION OF THE NAMED EXECUTIVE OFFICERS AND DIRECTORS

| | | | |

| | | | |

| | | | |

Summary Compensation Table | | | | |

| |

| |

| | | | |

| | | | |

| |

|

| |

| | | | |

| | | | |

| |

| | | | |

| |

| |

| | | | |

Review, Approval or Ratification of Related Person Transactions | | | | |

Transactions with Related Persons | | | | |

| | | | |

"HOUSEHOLDING" OF PROXY MATERIALS | | | | |

PROPOSALS OF STOCKHOLDERS | |

| | | |

i

SHUTTERSTOCK, INC.

350 Fifth Avenue, 21st Floor

New York, New York 10118

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

JUNE 7, 2016

GENERAL INFORMATION

Q:Who is soliciting my proxy?

A:- The Board of Directors (the

"Board"“Board”) of Shutterstock, Inc. ("(“we," "us"” “us” or the "Company"“Company”) is sendingsoliciting your proxy to vote at the Annual Meeting of Stockholders to be held on June 7, 2016 at 10:00 a.m., local time, and any adjournment or postponement of that meeting (the “2016 Annual Meeting”). The 2016 Annual Meeting will be held at our principal executive offices located at 350 Fifth Avenue, 21st Floor, New York, New York 10118. You may obtain directions to the location of the 2016 Annual Meeting by contacting our Investor Relations department at IR@shutterstock.com.

On or around April 28, 2016, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record as of April 20, 2016 (the “Record Date”), other than to those stockholders who previously requested electronic or paper delivery of proxy materials. The Notice directs stockholders to a website where they can access our proxy materials, including this proxy statement and our 2015 Annual Report to Stockholders (the “2015 Annual Report”). Stockholders may also view instructions regarding how to vote online or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive paper copies of our proxy materials or to receive our proxy materials electronically, you will continue to receive access to those materials through the method you requested until you elect otherwise.

The 2015 Annual Report, which contains our consolidated financial statements for the fiscal year ended December 31, 2015, accompanies this Proxy Statementproxy statement. You also may obtain a copy of our Annual Report on Form 10‑K for the fiscal year ended December 31, 2015 (the “2015 Form 10‑K”) that was filed with the Securities and Exchange Commission (the “SEC”), without charge, by contacting our Investor Relations department at the above street address or at IR@shutterstock.com. The 2015 Form 10‑K is also available in the “Investor Relations” section of our website at http://investor.shutterstock.com. Our website and the information contained therein are not incorporated into this proxy statement. If you would like us to send you a copy of any of the exhibits listed on the exhibit index of our 2015 Form 10‑K, we will do so upon your payment of our reasonable expenses in furnishing a requested exhibit.This proxy statement and our 2015 Form 10-K are also available free of charge on the SEC’s website at http://www.sec.gov.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 7, 2016:

THIS PROXY STATEMENT AND THE 2015 ANNUAL REPORT ARE

AVAILABLE AT

http://www.viewproxy.com/shutterstock/2016

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE 2016 ANNUAL MEETING

| |

| Q: | Why am I receiving these materials? |

| |

| A: | The Board has made these materials available to you on the Internet, or, upon your request, has delivered printed or emailed electronic proxy materials to you, in connection with the solicitation of proxies for use at the 2016 Annual Meeting, which will take place on Tuesday, June 7, 2016 at 10:00 a.m., local time, at our principal executive offices located at 350 Fifth Avenue, 21st Floor, New York, New York 10118. As a holder of our common stock on April 20, 2016, you are invited to attend the 2016 Annual Meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares. |

| |

| Q: | What is included in the proxy materials? |

| |

| A: | The proxy materials include: |

this proxy statement for the 2016 Annual Meeting;

the 2015 Annual Report; and

the proxy card or a voting instruction form for the 2016 Annual Meeting.

| |

| Q: | Who is soliciting my proxy? |

| |

| A: | The Board is sending you this proxy statement in connection with the Board’s solicitation of proxies for use at the 2016 Annual Meeting. Certain of our directors, officers and employees also may solicit proxies on the Board’s behalf by mail, telephone, email, fax or in person. |

In addition, we have retained Alliance Advisors, L.L.C., or Alliance, to assist us with the distribution of proxy materials and vote solicitation.

| |

| Q: | Who is paying for this solicitation? |

| |

| A: | We will pay for the solicitation of proxies. Our directors, officers and employees will not receive additional remuneration. We will reimburse banks, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of our common stock in accordance with applicable rules. |

Pursuant to our agreement with Alliance, we will pay Alliance approximately $8,000 plus expenses for the solicitation services being provided in connection with the

Board's solicitation of proxies for use at the 20142016 Annual

Meeting of Stockholders or any adjournment or postponement thereof (the "Annual Meeting"). Certain of our directors, officers and employees also may solicit proxies on the Board's behalf by mail, telephone, email, fax or in person.Q:Who is paying for this solicitation?

A:We will pay for the solicitation of proxies. Our directors, officers and employees will not receive additional remuneration. We will reimburse banks, brokers, custodians, nominees and fiduciaries for their reasonable charges and expenses to forward our proxy materials to the beneficial owners of our common stock.

Q:What am I voting on?

A:You will be voting on two proposals. Proposal One is for the election of Jeff Epstein and Jonathan Miller to the Board for three-year terms ending at the 2017 Annual Meeting of Stockholders. | |

| A: | You will be voting on four proposals. Proposal One is to elect each of Jonathan Oringer and Jeffrey Lieberman to the Board, each to serve as a Class I director for a three‑year term ending at the 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”). |

Proposal Two is forto approve, on an advisory basis, the ratificationcompensation of our named executive officers, as disclosed in this proxy statement.

Proposal Three is to approve an amendment and restatement of our 2012 Omnibus Equity Incentive Plan (the “2012 Plan”).

Proposal Four is to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for

the fiscal year

2014.Q:Who can vote?ending December 31, 2016, or fiscal 2016.

A:Only our stockholders of record at the close of business on April 17, 2014 may vote. Each share of common stock outstanding on that date is entitled to one vote on all matters to come before the meeting.

Q:Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

A:Pursuant to rules adopted by the Securities and Exchange Commission (the "SEC"), we have elected to provide

| |

| A: | Only our stockholders of record at the close of business on April 20, 2016, the Record Date, may vote. Each share of our common stock outstanding on that date is entitled to one vote on all matters to come before the 2016 Annual Meeting. |

| |

| Q: | Why did I receive a one‑page notice in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials? |

| |

| A: | In accordance with rules adopted by the SEC, we may furnish proxy materials, including this proxy statement and our 2015 Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice, which was mailed to most of our stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. |

| |

| Q: | How can I access the proxy materials over the Internet? |

| |

| A: | The Notice, proxy card or voting instruction form you receive will contain instructions on how to: |

view our proxy materials consisting offor the Notice of2016 Annual Meeting this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as filed with the SEC on February 28, 2014, over the Internet. Therefore, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders. Starting on the date of distribution of the Notice, all stockholders will have the abilityInternet and vote your shares; and

instruct us to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found in the Notice. If you request printed versions of the proxy materials by mail, the materials will also include a proxy card or other voting instruction form.

Q:Can I receive proxy materials for future Annual Meetings by email rather than receiving a paper copy of the Notice?

A:The Notice provides you with instructions regarding how to request that we send our future proxy materials to you either by mail or electronically by email.

Our proxy materials are also available for viewing at http://www.viewproxy.com/shutterstock/2016.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the environmental impact of printing and mailing these materials. If you choose to receive future proxy materials by email, next year you will receive an email next year with instructions on howcontaining a link to view those materials and vote beforea link to the next Annual Meeting.proxy voting site. Your choiceelection to obtain documentsreceive proxy materials by email will remain in effect until you notify us otherwise. Delivering future notices by email will help us further reduce the cost and environmental impact of our stockholder meetings.revoke it.

| |

| Q: | What is the difference between a stockholder of record and a “street name” holder? |

| |

| A: | If your shares are registered directly in your name with American Stock Transfer & Trust Company, our stock transfer agent, you are considered the stockholder of record for those shares. |

Table of Contents

Q:What is the difference between a stockholder of record and a "street name" holder?

A:If your shares are registered directly in your name with American Stock Transfer & Trust Company, our stock transfer agent, you are considered the stockholder of record for those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of the shares, and your shares are said to be held in "street“street name."” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank or other nominee how to vote their shares using the method described under "How“How do I vote and how do I revoke my proxy?"” below.

| |

| Q: | How do I vote and how do I revoke my proxy? |

| |

| A: | If you hold your shares in your own name as a stockholder of record, you may vote your shares either in person at the meeting or by proxy. To vote in person, please bring a form of identification, such as a valid driver’s license or passport, and proof that you were a stockholder as of April 20, 2016, and we will give you a ballot when you arrive. To vote by proxy, please vote in one of the following ways: |

Q:How do I vote and how do I revoke my proxy?

A:If you hold your shares in your own name as a stockholder of record, you may vote your shares either in person at the meeting or by proxy. To vote in person, please bring a form of identification, such as a valid driver's license or passport, and proof that you are a stockholder as of April 17, 2014, and we will give you a ballot when you arrive. To vote by proxy, please vote in one of the following ways:

•- Via the Internet.You may vote through the Internet

atwww.proxyvote.com by following the instructions provided in the Notice.Notice, proxy card or voting instruction form.

•- By Telephone.

If you received your proxy materials or request printed copies by mail, stockholdersStockholders located in the United States may vote by calling the toll-freetoll‑free number found onprovided in the Notice, proxy card.card or voting instruction form.

•- By Mail.If you requested and received printed copies of your proxy materials

or request printed copies by mail, you may vote by mail by marking, dating, signing and mailing the proxy card in the envelope provided.

Voting by proxy will not affect your right to vote your shares if you attend the 2016 Annual Meeting and want to vote in person—person; by voting in person you automatically revoke your proxy. You also may revoke your proxy at any time before the applicable voting deadline by givingsending our Secretary written notice of your revocation at Shutterstock, Inc., Attention: Secretary, 350 Fifth Avenue, 21st Floor, New York, New York 10118, by submitting a later-datedlater‑dated proxy card or by voting again using the telephone or Internet (your latest telephone or Internet proxy is the one that will be counted). If you vote by proxy, the individuals named as proxyholders will vote your shares as you instruct. If you vote your shares over the telephone, you must select a voting option ("For"(“For” or "Withhold"“Withhold” (for directors),each director nominee in Proposal One) and "For," "Against"“For,” “Against” or "Abstain"“Abstain” (for Proposal Two)Proposals Two, Three and Four)) in order for your proxy to be counted on that matter. If you validly vote your shares over the Internet or by mail but do not provide any voting instructions, the individuals named as proxyholders will vote your sharesFOR the election of each of the nominees for director, FOR the approval of the compensation of our named executive officers, as disclosed in this proxy statement, FOR approval of the amendment and restatement of our 2012 Plan, and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2014.2016. If your shares are registered in street name, you must vote your shares in the manner prescribed by your broker, bank, or other nominee. In most instances, you can do this over the telephone or Internet, or if you have received or requestrequested a hard copy of the proxy statement and accompanying voting instruction form, you may mark, sign, date and mail your voting instruction form in the envelope your bank or broker provides. The Notice that was mailed to you has specific instructions for how to submit your vote and the deadline for doing so. If you would like to revoke your proxy, you must follow the bank, broker, or other nominee'snominee’s instructions on how to do so. If you wish to vote in person at the 2016 Annual Meeting, you must obtain and present at the 2016 Annual Meeting a legal proxy from the bank, broker or other nominee holding your shares.

| |

| Q: | What is the deadline for submitting a proxy? |

| |

| A: | Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day. In order to be counted, proxies submitted by telephone or the Internet must be received by 11:59 p.m. Eastern Time on June 6, 2016. Proxies submitted by mail must be received prior to the start of the 2016 Annual Meeting. |

| |

| Q: | What constitutes a quorum? |

| |

| A: | On the Record Date, we had 35,042,285 shares of common stock, $0.01 par value per share, outstanding. Voting can take place at the 2016 Annual Meeting only if stockholders owning a majority of the issued and outstanding stock entitled to vote at the 2016 Annual Meeting are present in person or represented by proxy. Abstentions and broker non-votes, as described below, are counted for the purpose of determining a quorum. |

| |

| Q: | What are abstentions and broker non‑votes and how do they affect voting? |

| |

| A: | Abstentions ‑ If you specify that you wish to “abstain” from voting on an item, your shares will not be voted on that particular item. |

Table of Contents

Q:What is the deadline for submitting a proxy?

A:Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day. In order to be counted, proxies submitted by telephone or the Internet must be received by 11:59 p.m. Eastern Time on June 11, 2014. Proxies submitted by mail must be received prior to the start of the Annual Meeting.

Q:What constitutes a quorum?

A:On the record date, we had 35,197,284 shares of common stock, $0.01 par value per share, outstanding. Voting can take place at the Annual Meeting only if stockholders owning a majority of the issued and outstanding stock entitled to vote at the Annual Meeting are present in person or represented by proxy.

Q:What are abstentions and broker non-votes and how do they affect voting?

A:Abstentions—If you specify that you wish to "abstain" from voting on an item, your shares will not be voted on that particular item. Abstentions are counted toward establishing a quorum and included in the shares entitled to vote on Proposal Two. On Proposal Two, abstentions have the effect of a vote against the proposal.

Broker Non-Votes ‑ —Under the New York Stock Exchange ("NYSE"(“NYSE”) rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote these shares on certain "routine"“routine” matters, including the ratification of the appointment of theour independent registered public accounting firm. However, on non-routine matters such as the election of directors, the advisory vote on the compensation of our named executive officers and approval of the amendment and restatement of our 2012 Plan, your broker must receive voting instructions from you, as it does not have discretionary voting power for thatthose particular item.items. So long as the broker has discretion to vote on at least one proposal, these "broker non-votes"“broker non-votes” are counted toward establishing a quorum. When voted on "routine"“routine” matters, broker non-votes are counted toward determining the outcome of that "routine"“routine” matter.

Q:What vote is needed?Effect of Abstentions and Broker Non-Votes ‑

A:- For Proposal One, the election of directors, only votes “for” or “withheld” count. Neither abstentions nor broker non-votes will have any effect on the

two nominees receivingoutcome of voting with respect to the highest numberelection of votesthe directors. Proposals other than for the election of directors shall be approved by the affirmative vote of the holders of a majority of the shares of our common stock present at the 2016 Annual Meeting, in person or represented by proxy, at the Annual Meeting and entitled to vote on Proposal Onethereon. Abstentions will be electedcounted towards the tabulation of votes cast on these proposals presented to stockholders and will have the same effect as directors. As a result, if you withhold your authority to vote for any nominee, your votenegative votes, whereas broker non-votes will not affect the outcomebe counted for purposes of the election. In no case may stockholders cumulate votes for the election of directors.

| |

| A: | For Proposal One, the two nominees receiving the highest number of votes of the shares present in person or represented by proxy at the 2016 Annual Meeting and entitled to vote on Proposal One will be elected as directors. As a result, if you withhold your authority to vote for any nominee, your vote will not affect the outcome of the election. In no case may stockholders cumulate votes for the election of directors. |

For Proposal Two, an affirmative vote of the majority of shares present in person or represented by proxy at the 2016 Annual Meeting and entitled to vote on Proposal Two is required to approve, on an advisory basis, the ratificationcompensation of our named executive officers.

For Proposal Three, an affirmative vote of the majority of shares present in person or represented by proxy at the 2016 Annual Meeting and entitled to vote on Proposal Three is required to approve the amendment and restatement of our 2012 Plan.

For Proposal Four, an affirmative vote of the majority of shares present in person or represented by proxy at the 2016 Annual Meeting and entitled to vote on Proposal Four is required to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

Q:What happens if a director receives a plurality, but not a majority, of votes cast at the Annual Meeting?

A:In an uncontested election, if a nominee for director who is an incumbent director is elected by a plurality of the votes cast but does not receive the vote of at least the majority of the votes cast (i.e., the number of shares voted "for" a director's election does not exceed 50% of the total number of votes cast with respect to that director's election, including votes to withhold authority), the director is deemed elected.

Table of Contents

Q:May I propose actions for consideration at next year's Annual Meeting of stockholders or nominate individuals to serve as directors?

A:You may present proposals for action at a future meeting or submit nominations for election of directors only if you comply with the requirements of the proxy rules established by the SEC and our amended and restated bylaws, as applicable. In order for a stockholder proposal to be included in our proxy statement and form of proxy relating to the meeting for our 2015 Annual Meeting of Stockholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the proposal must be received by us no later than December 29, 2014. In addition, under our amended and restated bylaws, any proposal for consideration at our Annual Meeting of stockholders to be held in 2015 submitted by a stockholder other than pursuant to Rule 14a-8 will be considered timely if it is received by Shutterstock's Secretary at our principal executive offices between the close of business on February 12, 2015 and the close of business on March 14, 2015, and is otherwise in compliance with the requirements set forth in our amended and restated bylaws. If the date of the 2015 Annual Meeting is more than 30 days before or after such anniversary date, notice by the stockholder must be received not later than the close of business on the later of the ninetieth (90th) day prior to such Annual Meeting or the tenth (10th) day following the date on which public announcement of the date of the 2015 | |

| Q: | What happens if a director receives a plurality, but not a majority, of votes cast at the 2016 Annual Meeting? |

| |

| A: | In an uncontested election, if a nominee for director who is an incumbent director is elected by a plurality of the votes cast but does not receive the vote of at least the majority of the votes cast (i.e., the number of shares voted “for” a director’s election does not exceed 50% of the total number of votes cast with respect to that director’s election, including votes to withhold authority), the director is deemed elected. |

| |

| Q: | May I propose actions for consideration at next year’s Annual Meeting of Stockholders or nominate individuals to serve as directors? |

| |

| A: | You may present proposals for action at a future meeting or submit nominations for election of directors only if you comply with the requirements of the proxy rules established by the SEC and our amended and restated bylaws, as applicable. In order for a stockholder proposal to be included in our proxy statement and form of proxy relating to the meeting for our 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”) pursuant to Rule 14a‑8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the proposal must be received by us no later than December 29, 2016. In addition, under our amended and restated bylaws, any proposal for consideration at our 2017 Annual Meeting submitted by a stockholder other than pursuant to Rule 14a‑8 will be considered timely if it is received by Shutterstock’s Secretary at our principal executive offices between the start of business on February 7, 2017 and the close of business on March 9, 2017, and is otherwise in compliance with the requirements set forth in our amended and restated bylaws. If the date of the 2017 Annual Meeting is more than 30 days before or after June 7, 2017 (the one-year anniversary of our 2016 Annual Meeting), notice by the stockholder must be received not later than the close of business on the later of the 90th day prior to the 2017 Annual Meeting or the 10th day following the date on which public announcement of the date of the 2017 Annual Meeting is first made by Shutterstock. We will disclose any new deadline by which stockholder proposals must be received under Item 5 of Part II of our earliest possible Quarterly Report on Form 10-Q or, if impracticable, by a means reasonably determined to inform stockholders. |

Our amended and restated bylaws require that certain information and acknowledgments with respect to the proposal or the nominee, as applicable, and the stockholder making the proposal or the nomination be set forth in the notice. With regards to nominations for director forat our 20152017 Annual Meeting, of Stockholders, the notice must include all information about the nominee that must be disclosed in proxy solicitations pursuant to Regulation 14A under the Exchange Act (including the nominee'snominee’s written consent to being named as a nominee and serving as a director) and a description of all material monetary agreements during the past three years and any other material relationships, between such stockholder and a beneficial owner on whose behalf the nomination is made and their affiliates and associates, or others acting in concert, on the one hand, and each proposed nominee, and his/her affiliates and associates, or others acting in concert, on the other hand, including all information that would be required to be disclosed pursuant to Rule 404 under Regulation S-KS‑K if the stockholder were a "registrant,"“registrant,” all as described in our amended and restated bylaws. The notice must also include certain additional information about and representations by the stockholder and/or the beneficial owner, all as detailed in our amended and restated bylaws. Our amended and restated bylaws have been publicly filed with the SEC and can also be found on our website at www.shutterstock.com in the Corporate Governance section of our investor relationsInvestor Relations webpage.

Q:Can I vote on other matters?

A:We do not expect any matters other than those listed in this Proxy Statement to come before the Annual Meeting. If any other matter is presented, your proxy gives the individuals named as proxyholders the authority to vote your shares to the extent authorized by Rule 14a-4(c) under the Exchange Act, which includes matters that the proxyholders did not know were to be presented at the Annual Meeting.

Q:How does the Board select nominees for the Board?

A:The Nominating and Corporate Governance Committee will consider potential candidates for directors submitted by stockholders, in addition to those suggested by other Board members and members of our management. The Nominating and Corporate Governance Committee considers and evaluates each properly submitted potential candidate for director in an effort to achieve a balance of skills and characteristics on the Board, as well as to ensure that the composition of the Board at all times adheres to the independence requirements applicable to NYSE-listed companies

TableIf a stockholder who has notified us of

Contentshis or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we are not required to present the proposal for a vote at such meeting. We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal or nomination that does not comply with these and other regulatoryapplicable requirements contained in our amended and restated bylaws and applicable to us. Please refer to Proposal One—Election of Directors and our Corporate Governance Guidelines for additional details on our policy, process and membership criteria. A stockholder may recommend potential candidates for director by notifying our Secretary at Shutterstock, Inc., 350 Fifth Avenue, 21st Floor, New York, New York 10118.

Q:How may I communicate with the Board of Directors?

A:Stockholders and other interested parties may communicate directly with the Board, with any director or with the independent directors as a group or any other group of directors by writing to our Secretary at Shutterstock, Inc., 350 Fifth Avenue, 21st Floor, New York, New York 10118, with a request to forward to communication to the intended recipient or recipients. Messages received will be forwarded to the appropriate director or directors.

Q:When and where is the Annual Meeting being held?

A:The Annual Meeting will be held on Thursday, June 12, 2014 at 10:00 a.m. (Eastern Daylight Time) at the offices of Shutterstock, Inc. at 350 Fifth Avenue, New York, New York 10118. If you need directions to the Annual Meeting so that you may attend or vote in person, please contact our Investor Relations department atIR@Shutterstock.com.

Q:How can I find the results of the Annual Meeting?

A:Preliminary results will be announced at the Annual Meeting. Final results also will be published in a current report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

laws. | |

| Q: | Can I vote on other matters? |

| |

| A: | We do not expect any matters other than those listed in this proxy statement to come before the 2016 Annual Meeting. If any other matter is presented, your proxy gives the individuals named as proxyholders the authority to vote your shares to the extent authorized by Rule 14a‑4(c) under the Exchange Act, which includes matters that the proxyholders did not know were to be presented at the 2016 Annual Meeting. |

| |

| Q: | How does the Board select nominees for the Board? |

| |

| A: | The Nominating and Corporate Governance Committee will consider potential candidates for directors submitted by stockholders, in addition to those suggested by other Board members and members of our management. The Nominating and Corporate Governance Committee considers and evaluates each properly submitted potential candidate for director in an effort to achieve a balance of skills and characteristics on the Board, as well as to ensure that the composition of the Board at all times adheres to the independence requirements applicable to NYSE‑listed companies and other regulatory requirements applicable to us. Please refer to Proposal One-Election of Directors and our Corporate Governance Guidelines for additional details on our policy, process and membership criteria. A stockholder may recommend potential candidates for director by notifying our Secretary at Shutterstock, Inc., 350 Fifth Avenue, 21st Floor, New York, New York 10118. |

| |

| Q: | How may I communicate with the Board? |

| |

| A: | Stockholders and other interested parties may communicate directly with the Board, with any director, including our Presiding Director, or with the independent directors as a group or any other group of directors by writing to our Secretary at Shutterstock, Inc., 350 Fifth Avenue, 21st Floor, New York, New York 10118, with a request to forward the communication to the intended recipient or recipients. Messages received with such a request will be forwarded to the appropriate director or directors. |

| |

| Q: | When and where is the 2016 Annual Meeting being held? |

| |

| A: | The 2016 Annual Meeting will be held on Tuesday, June 7, 2016 at 10:00 a.m., local time, at the principal executive offices of Shutterstock, Inc. at 350 Fifth Avenue, 21st Floor, New York, New York 10118. If you need directions to the 2016 Annual Meeting so that you may attend or vote in person, you may contact our Investor Relations department at IR@Shutterstock.com. |

| |

| Q: | How can I find the results of the 2016 Annual Meeting? |

| |

| A: | Preliminary results will be announced at the 2016 Annual Meeting. Final results also will be published in a current report on Form 8‑K to be filed with the SEC within four business days after the 2016 Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8‑K and will provide the final results in an amendment to the Form 8‑K as soon as they become available. |

Table of Contents

PROPOSAL ONE

Our Board; Selection of Nominees

Our certificate of incorporation and amended and restated bylaws provide that our business is to be managed by or under the direction of our Board. Our Board is divided into three classes

serving staggered three-year terms. At thefor purposes of election. One class is elected at each Annual Meeting

you and the other stockholders will elect two individualsof Stockholders to serve

for a three‑year term. Our Board currently consists of five members, classified into three classes as

follows: Jonathan Oringer and Jeffrey Lieberman serve as Class I directors

for three-year terms that endwith a term ending at the 2016 Annual Meeting; Jeff Epstein serves as a Class II director with a term ending at the 2017 Annual

Meeting; and Thomas R. Evans and Paul J. Hennessy serve as Class III directors with a term ending at the 2018 Annual Meeting of

Stockholders.Stockholders (the “2018 Annual Meeting”).

Our Nominating and Corporate Governance Committee is charged with identifying, evaluating and recommending

director nominees to the full

Board director nominees.Board. There are no minimum qualifications for director. While we do not have a formal diversity policy for Board membership, the Nominating and Corporate Governance Committee generally seeks individuals with a wide range of attributes, including international business experience and experience in industries beyond technology. We also look for financial oversight experience, financial community experience and a good reputation

withwithin the financial community; business management experience and the potential to succeed top management in the event Board intervention is necessary on an unexpected basis; business contacts, business knowledge and influence that may be useful to our

businessesbusiness and product lines; and knowledge about our industries and technologies. We believe that all of our directors should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform and carry out all director duties in a responsible manner. Each director must also represent the interests of all stockholders.

Both

Our Board, upon the recommendation of the Nominating and Corporate Governance Committee, has voted to nominate each of Messrs. Oringer and Lieberman for election to the Board as Class I directors at the 2016 Annual Meeting to serve for a term of three years until the 2019 Annual Meeting, and until their respective successors have been elected and qualified or, if sooner, until their respective death, resignation or removal. Each of the nominees

Jeff Epstein and Jonathan Miller, are now membersis currently a member of the Board.

The

individuals namednominees have indicated their willingness to serve if elected. Our Board has no reason to believe that the nominees will be unable or unwilling to serve if elected. Shares represented by all proxies received by our Board and not marked as

proxyholderswithholding authority to vote for any of the Class I director nominees will

vote your proxy forbe voted “FOR” the election of the

twoClass I director nominees, unless

you direct thema nominee is unable or unwilling to

withhold your vote.serve. If any

nominee becomesof the director nominees should be unable to serve,

as a director before the

Annual Meeting (or decides not to serve), the individuals named as proxyholdersshares of common stock represented by proxies may

votebe voted for a

substitute.substitute nominee or nominees designated by our Board. A plurality of the votes cast in the election of the directors is required to elect each of the nominees to our Board.

Set forth below are the names and ages of these nominees and theour other continuing directors, when they became a director, their principal occupations or employment for at least the past five years, and the names of other public companies for which they serve as a director or have served as a director during at least the past five years. Also set forth below are the specific experience, qualifications, attributes or skills that led our Nominating and Corporate Governance Committee to conclude that each person should serve as a director. All of our directors have held high-levelhigh‑level positions in companies and have experience in dealing with complex issues. We believe that each is an individual of high character and integrity and has the ability to exercise sound judgment.

No director is related by blood, marriage or adoption to any other director or executive officer. No arrangements or understandings exist between any director or person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director.

Table of Contents

Nominees for Election for a Three-YearThree‑Year Term Ending withExpiring at the 20172019 Annual Meeting

|

| |

•

Jeff Epstein

| | Age 57. Jeff Epstein has served as a member of our Board since April 2012. Mr. Epstein is an Operating Partner at Bessemer Venture Partners, which he joined in November 2011, and is a Senior Advisor at Oak Hill Capital Partners, which he joined in August 2011. Mr. Epstein has served as a director of priceline.com since April 2003 and of Global Eagle Entertainment since January 2013. Mr. Epstein was Executive Vice President and Chief Financial Officer of Oracle Corporation from September 2008 to April 2011. From June 2007 to October 2008, Mr. Epstein was a director of MDC Partners Inc. Mr. Epstein was Executive Vice President and Chief Financial Officer of Oberon Media from April 2007 to June 2008. Mr. Epstein is currently a director of Kaiser Foundation Hospitals and Health Plan. Mr. Epstein holds a B.A. from Yale University and an M.B.A. from Stanford University. The Board believes that Mr. Epstein's financial and business expertise, including his background as chief financial officer of the world's largest enterprise software company, and his service as a senior executive at companies in the internet and advertising industries, qualifies him to serve as a member of our Board. |

•

Jonathan Miller

| | Age 57. Jonathan Miller has served as a member of our Board since March 2012. Mr. Miller served as the Chairman and Chief Executive Officer of the Digital Media Group at News Corp. and was its Chief Digital Officer from April 2009 to September 2012. Mr. Miller was the Founder and Partner at Velocity Interactive Group, an investment firm focusing on internet and digital media, from its inception in February 2007 to April 2009. Prior to founding Velocity, Mr. Miller served as the Chief Executive Officer of America Online, Inc., or AOL. Prior to joining AOL, Mr. Miller served as Chief Executive Officer and President of USA Information and Services. Mr. Miller previously served as a director of LiveNation Entertainment, Inc. and Ticketmaster prior to its merger with LiveNation. Mr. Miller is a trustee of the American Film Institute and The Paley Center for Media. Mr. Miller holds a B.A. from Harvard College. The Board believes that Mr. Miller's business expertise, particularly as a senior executive at some of the largest digital media companies in the world, and his service on the boards of directors of various public companies, qualifies him to serve as a member of our Board.

|

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE ABOVE NOMINEES.

Table of Contents

Directors Continuing in Office Until the 2015 Annual Meeting

| | |

•

Steven Berns

| | Age 49. Steven Berns has served as a member of our Board since March 2012. Since June 2013, Mr. Berns has served as Executive Vice President and Chief Financial Officer of Tribune Company. From February 2010 to June 2013, Mr. Berns served as the Executive Vice President and Chief Financial Officer of Revlon, Inc., and he served as its Treasurer from May 2009 to February 2010. Mr. Berns previously served as Chief Financial Officer of Tradeweb, LLC from November 2007 to May 2009. From November 2005 until July 2007, Mr. Berns served as President, Chief Financial Officer and Director of MDC Partners Inc, and from September 2004 to November 2005, Mr. Berns served as its Vice Chairman and Executive Vice President. Prior to that, Mr. Berns was the Senior Vice President and Treasurer of The Interpublic Group of Companies, Inc. from August 1999 until September 2004. Before that, Mr. Berns held a variety of positions in finance with Revlon, Inc. from April 1992 until August 1999. Prior to joining Revlon, Inc., Mr. Berns worked at Paramount Communications Inc. and at a predecessor public accounting firm of Deloitte & Touche. Mr. Berns formerly served as a director of LivePerson, Inc. Mr. Berns holds a B.S. from Lehigh University and an M.B.A. from New York University and is a Certified Public Accountant. The Board believes that Mr. Berns' financial and business expertise, including his background as a senior executive at one of the world's largest advertising holding companies, chief financial officer of several corporations, and his service on the boards of directors and audit committees of public companies, qualifies him to serve as a member of our Board. |

•

Thomas R. Evans

| | Age 59. Thomas R. Evans has served as a member of our Board since March 2012. Mr. Evans served as President and Chief Executive Officer and a director of Bankrate, Inc. from March 2004 until December 2013. From August 1999 to August 2003, Mr. Evans served as Chairman and Chief Executive Officer of Official Payments Corp., specializing in processing consumer credit card payments for government taxes, fees and fines. From 1998 to 1999, Mr. Evans was President and Chief Executive Officer of GeoCities Inc., a community of personal websites. From 1991 to 1998, Mr. Evans was President and Publisher ofU.S. News & World Report. In addition to his duties atU.S. News & World Report, Mr. Evans served as President ofThe Atlantic Monthly (1996 - 1998) and as President and Publisher ofFast Company (1995 -1998), a magazine launched in 1995. Mr. Evans also serves as a director of Future Fuel Corp. and previously served as a director of Navisite, Inc. Mr. Evans holds a B.S. in business administration from Arizona State University. The Board believes that Mr. Evans' business experience, particularly as a senior executive in the internet and media industries, and his service on the board of directors of public companies, qualifies him to serve as a member of our Board.

|

Table of Contents

Directors Continuing in Office Until the 2016 Annual Meeting

| | |

•

Jonathan Oringer | | Age 39.41. Jonathan Oringer has served as our Founder, Chief Executive Officer and Chairman of the Board since founding the companyCompany in 2003. Prior to founding Shutterstock, Mr. Oringer served as a director of several private companies. Mr. Oringer holds a B.S. in computer science and mathematics from State University of New York at Stony Brook and an M.S. in computer science from Columbia University.

The Board believes that Mr. Oringer'sOringer’s experience in the commercial digital imagery industry, his experience with entrepreneurial and technology companies and his extensive knowledge of our companyCompany as its founder qualify him to serve as Chairman of our Board.

|

•

Jeffrey Lieberman

| |

Jeffrey Lieberman | Age 39.41. Jeffrey Lieberman has served as a member of our Board since June 2007. Mr. Lieberman is a Managing Director of the private equity and venture capital firm Insight Venture Partners, or Insight, where he has been employed since June 1998. Prior to joining Insight, Mr. Lieberman was a management consultant at the New York office of McKinsey & Company, where he focused on strategic and operating issues in the financial services, technology and consumer products industries. Mr. Lieberman has served on the board of directors of Mimecast, a public company providing security, archiving, and continuity cloud services, since 2012 and on the board of directors of Cvent, Inc., a public event management technology company, since July 2011. Mr. Lieberman also serves as a director of several private companies. Mr. Lieberman holds a BAS in systems engineering and in BAa B.A. in economics from the Engineering School and Wharton School of the University of Pennsylvania, respectively.

The Board believes that Mr. Lieberman'sLieberman’s experience with digital media, entertainment and online technology companies, his extensive knowledge of our companyCompany as one of our original investors, and his service on the boards of directors of other companies qualifiesqualify him to serve as a member of our Board. |

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE ABOVE NOMINEES.

Director Continuing in Office Until the 2017 Annual Meeting |

| |

| Jeff Epstein | Age 59. Jeff Epstein has served as a member of our Board since April 2012. Mr. Epstein is an Operating Partner at Bessemer Venture Partners, a venture capital firm, which he joined in November 2011, and has served as a lecturer in the Department of Management Science & Engineering at Stanford University since 2014. From August 2011 through May 2014, Mr. Epstein was a part‑time Senior Advisor at Oak Hill Capital Partners, a private equity firm. Mr. Epstein was Executive Vice President and Chief Financial Officer of Oracle Corporation, the world’s largest enterprise software company, from September 2008 to April 2011. Mr. Epstein has served as a director of The Priceline Group, Inc., a public travel services company, since April 2003 and of Global Eagle Entertainment Inc., a leading worldwide provider of media content, technology and connectivity solutions to the travel industry, since January 2013. Mr. Epstein is currently a director of the non‑profit Kaiser Permanente and of several private companies. Mr. Epstein holds a B.A. from Yale College and an M.B.A. from Stanford University.

The Board believes that Mr. Epstein’s financial and business expertise, including his background as chief financial officer of the world’s largest enterprise software company, and his service as a senior executive at companies in the internet and advertising industries, qualify him to serve as a member of our Board. |

Directors Continuing in Office Until the 2018 Annual Meeting |

| |

| Thomas R. Evans | Age 61. Thomas R. Evans has served as a member of our Board since March 2012. Since January 2014, Mr. Evans has served as Advisor to the Board of Bankrate, Inc., a leading aggregator of financial rate information, and, from March 2004 until December 2013, Mr. Evans served as its President and Chief Executive Officer and a director. Mr. Evans served as a director of Millennial Media, Inc. a public mobile marketplace company, from 2014 to November 2015 and as a director of Future Fuel Corp., a public chemical manufacturing company, from 2005 until September 2015. Mr. Evans has served as a director of Angie's List, Inc., a national local services consumer review service and marketplace, since March 2016, and serves on its compensation committee. Mr. Evans holds a B.S. in business administration from Arizona State University.

The Board believes that Mr. Evans’ business experience, particularly as a senior executive in the internet and media industries, and his service on the board of directors of public companies, qualify him to serve as a member of our Board. |

| |

| Paul J. Hennessy | Age 51. Paul J. Hennessy has served as a member of our Board since April 2015. Since April 2015, Mr. Hennessy has served as Chief Executive Officer of priceline.com, a provider of online travel and travel related reservation and search services. From November 2011 to March 2015, Mr. Hennessy served as Chief Marketing Officer of Booking.com, an online booking accommodations provider. From July 2006 to October 2011, Mr. Hennessy was Chief Distribution Officer of priceline.com. Mr. Hennessy holds a B.S. in marketing management from Dominican College and an M.B.A. from Long Island University.

The Board believes that Mr. Hennessy’s business experience, particularly as a senior executive with online marketing experience in the internet and travel industries, qualify him to serve as a member of our Board. |

Governance of the Corporation

We are committed to strong corporate governance, and have adopted policies and practices that comply with or exceed the NYSE listing requirements and the Exchange Act. These policies and practices include:

Thethe Board has adopted clear corporate governance policies articulated in our Corporate Governance Guidelines, which includes basic director duties and responsibilities. Our Corporate Governance Guidelines can be found through the “Corporate Governance” link on the Investor Relations page on our website at

www.shutterstock.com

•A.a majority of theour Board members are independent of the Company and our management. The definition of "independent"“independent” is included in our Corporate Governance Guidelines, which can be found through the "Corporate Governance"“Corporate Governance” link on the Investor Relations page on our website at www.shutterstock.com.

•Allall members of our keystanding Board committees—committees - the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee—Committee - are independent.

•Thethe Board has also adopted a Code of Business Conduct and Ethics applicable to all of our employees, including theour executive officers and senior financial officers, and to our directors. Our Code of Business Conduct and Ethics requires, among other things, that all of our directors, officers and employees comply with all laws, avoid conflicts of interest, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. Our Code of Business Conduct and Ethics can be found through the “Corporate Governance” link on the Investor Relations page on our website at

www.shutterstock.com•We.we have a hotline for employees to report concerns regarding ethics and financial matters, including accounting, internal controls and audit concerns, and the Audit Committee has established procedures for anonymous submission of these matters.

Table of Contents

•Thethe Board has adopted a policy regarding conflicts of interest and "related-person transactions"“related‑person transactions” under which all potential conflicts of interest and related-personrelated‑person transactions must be reviewed and pre-approvedpre‑approved by the Nominating and Corporate GovernanceAudit Committee. The Nominating and Corporate GovernanceAudit Committee has determined that certain categories of transactions are pre-approvedpre‑approved under this policy. Please refer to the discussion under "Certain“Certain Relationships and Related Transactions"Transactions” for more information on this policy and the related procedures.

•The

the Board conducts an annual self-assessmenta periodic self‑assessment on its effectiveness and the effectiveness of each of its committees.

•Directors

directors are encouraged to attend all stockholder meetings.

•The Four of our six directors serving at that time attended our 2015 Annual Meeting of Stockholders.

the annual cycle of agenda items for Board and committee meetings reflects Board and committee requests and changing business and legal issues. The Board receives regularly scheduled presentations from our finance and legal departments and major business units and operations. The

Board'sBoard’s and

committees'committees�� annual agenda includes, among other items, our

long-termlong‑term strategic plans, periodic reports on progress against

long-termlong‑term strategic plans, emerging and disruptive technologies, potential acquisition or investment targets, review of risks relevant to our business, capital projects,

and evaluation of the

performance of our Chief Executive

Officer, and management and Board succession. Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our Board has determined that each of Messrs.

Berns, Epstein, Evans,

Hennessy and Lieberman,

and Miller, representing

fivefour of our

sixfive directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is

"independent"“independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the NYSE.

Our Board also determined that Messrs. Berns, Evans, Epstein and EpsteinHennessy, who comprise our Audit Committee (and Steven Berns, our current Chief Financial Officer and former director who served on our Audit Committee at some point during 2015), Messrs. Berns, Evans and MillerHennessy who comprise our Compensation Committee (and Mr. Berns and Jonathan Miller, our former directors, each of whom served on our Compensation Committee at some point during 2015), and Messrs. Epstein Evans and MillerEvans, who comprise our Nominating and Corporate Governance Committee (and Mr. Miller, our former director who served on our Nominating and Corporate Governance Committee at some point during 2015), satisfy or satisfied the independence standards for those committees established by applicable SEC rules and the listing requirements and rules of the NYSE. In

making this determination, our Board considered the relationships that each

non-employeenon‑employee director has

or had with

our companythe Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our

capitalcommon stock by each

non-employeenon‑employee director.

The Board met five times in fiscal year 2013. We have three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each current director attended at least 75% of the total Board meetings and meetings of the committees on which they serve that were held in fiscal year 2013.

Board Leadership Structure

The Board has adopted Corporate Governance Guidelines designed to promote the functioning of the Board and its committees. These Guidelines address Board composition, Board functions and responsibilities, qualifications, leadership structure, committees and meetings.

Table of Contents

Our Corporate Governance Guidelines do not indicate a particular Board structure, and the Board is given the flexibility to select its Chairman and our Chief Executive Officer in the manner that it believes is in the best interests of our stockholders. Accordingly, the positions of Chairman and the Chief Executive Officer may be filled by either one individual or two.two individuals. The Board has not separated the positions of Chairman of the Board and Chief Executive Officer. Both positions are currently held by Mr. Oringer. TheIn October 2014, the Board does not have a "Presiding Director." appointed Mr. Evans as our “Presiding Director” to preside over non‑management and executive sessions of the Board.

The Board believes that this structure has historically served the

companyCompany well and continues to do so by creating a critical link between management and the Board, enabling the Board to perform its oversight function with the benefits of

management'smanagement’s perspectives on the business, facilitating communication between the Board and our senior management, and providing the Board with direct oversight of our business and affairs.

In the Board’s view, separating the positions of Chairman and Chief Executive Officer has the potential to give rise to divided leadership, which could interfere with good decision‑making or weaken the Company’s ability to develop and implement strategy. Instead, the Company believes that combining the positions of Chairman and Chief Executive Officer provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Company believes that a combined Chairman/Chief Executive Officer is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information. The Company also believes that it is advantageous to have a Chairman with an extensive history with and knowledge of the Company (as is the case with Mr. Oringer, who founded the Company in 2003), as compared to a relatively less informed independent Chairman of the Board.

Stockholder Communication with the Board

Stockholders and other interested parties may communicate directly with the Board, with any director, including our Presiding Director, or with the independent directors as a group or any other group of directors by writing to our Secretary at Shutterstock, Inc., 350 Fifth Avenue, 21st Floor, New York, New York 10118, with a request to forward such communication to the intended recipient or recipients. Messages received with such a request will be forwarded to the appropriate director or directors. If the communication is addressed to the Presiding Director, the communication will be forwarded directly to the Presiding Director and will not be processed by the Secretary. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the Chair of the Audit, Compensation, or Nominating and Corporate Governance Committee, as the Secretary deems appropriate or necessary.

Board Meetings

The Board met nine times during 2015, either in person or by teleconference, and took action by unanimous written consent four times. Each current director who served as a director in 2015 attended at least 75% of the aggregate meetings of the Board and of the committees on which he served that were held during 2015, with the exception of Mr. Hennessy, who attended two of the three Audit Committee meetings that were held between August 3, 2015, the date on which he was appointed to the Audit Committee, and the end of 2015. In addition to the meetings of the committees of the Board, which are described below, the non‑employee members of our Board met five times in executive session without members of management present during 2015.

Board Committees and Committee Meetings

We have three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each of our standing committees has a written charter approved by the Board that clearly establishes the committee'scommittee’s roles and responsibilities. Copies of the charters for the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics, can be found through the "Corporate Governance"“Corporate Governance” link on the Investor Relations page on our website at www.shutterstock.com. Please note that information on, or that can be accessed through, our

website is not part of the proxy soliciting materials, is not deemed "filed"“filed” with the SEC and is not to be incorporated by reference into any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, and, except for information filed by the Company under the cover of Schedule 14A, is not deemed to be proxy soliciting materials.

The following table provides information regarding the current membership of each of the Board committees and the number of meetings held by each committee in 2015:

|

| | | | | | | | | | | | | |

| Name | | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| Jonathan Oringer | | | | | | |

| Jeff Epstein | | | | | | ü |

| Thomas R. Evans | | ü | | | | |

| Paul J. Hennessy | | ü | | ü | | |

| Jeffrey Lieberman | | | | | | |

| Total meetings in 2015 | | 7 | | 4 | | 1 |

| Committee Chairman |

Additionally, Jonathan Miller served as a member of our Compensation Committee until April 2015 and as the chairman of our Nominating and Corporate Governance Committee until his resignation from the Board on November 10, 2015, and Steven Berns served as the chairman of our Audit Committee:Committee and as a member of our Compensation Committee until his resignation from the Board in August 2015 in contemplation of his becoming our Chief Financial Officer.

Below is a description of each committee of the Board.

Audit Committee Our: As more fully set forth in its charter, our Audit Committee assists the Board in its oversight of our corporate accounting and financial reporting process and internal controls over financial reporting. OurThe responsibilities of our Audit Committee evaluatesinclude:

appointing, approving the compensation of, and assessing the independence of the our independent registered public accounting firm's qualifications, independence and performance; appoints and provides forfirm;

overseeing the compensationwork of the independent registered public accounting firm; approves the retention of theour independent registered public accounting firm, to perform any proposed permissible professional services; meetsincluding through the receipt and consideration of reports from such firm;

reviewing and discussing with management and theour independent auditor to discussregistered public accounting firm our annual and quarterly financial statements; instructsstatements and related disclosures;

coordinating the independent auditor to report to the audit committee on all of our critical accounting policies; reviews and discusses with management and the independent auditor management's report on internal control over financial reporting, and the independent auditor's audit of the effectivenessBoard’s oversight of our internal control over financial reporting;reporting, disclosure controls and discussesprocedures, and code of business conduct and ethics;

overseeing our internal audit function;

discussing our risk management policies;

establishing procedures for the receipt and retention of accounting related complaints and concerns;

meeting independently with managementour senior internal audit executive, our independent registered public accounting firm, and management;

reviewing and approving or ratifying any related person transactions; and

preparing the independent auditoraudit committee report required by SEC rules.

From January 1, 2015 until August 3, 2015, the

resultsmembers of our

annual audits and the reviews of our quarterly financial statements. The members of the Audit Committee arewere Steven Berns (Chairman), Jeff Epstein and Thomas R. Evans. Mr. Berns, who has served as our Chief Financial Officer since September 2015, resigned from our Board and all committees on which he served on August 3, 2015 and, since that date, the members of our Audit Committee have been Jeff Epstein (Chairman), Thomas R. Evans and Paul J. Hennessy. The Audit Committee met fiveseven times in fiscal year 2013.2015. Each member of the Audit Committee meets the additional requirements regarding independence for Audit Committee members under the NYSE listing requirements. The Board has determined that each of Steven Berns and Jeff Epstein is an "audit“audit committee financial expert"expert” as defined in Item 407(d)(5) of Regulation S-KS‑K under the Exchange Act based upon theirhis experience as Chief Financial

Officer of several companies. The Board has also determined that

each of Mr. Evans

and Mr. Hennessy is financially literate based upon his familiarity with financial statements.

Compensation Committee:Committee Our: As more fully set forth in its charter, our Compensation Committee establishesassists the Board in the Board’s oversight of the Company’s compensation program by establishing and reviewsreviewing policies and practices relating to the compensation and benefits of our executive officers, including establishing goals and objectives relevant to the compensation of our chiefChief Executive Officer and other executive officer and other senior officers, evaluating the performance of these officers in light of those goals and objectives and determining and approving or recommending for approval the compensation of these officers based on such evaluations. The Compensation Committee also establishes the Company’s general compensation policies and practices and periodically reviews and makes recommendations to the Board regarding the compensation of the Chairman of our Board and non-employee directors. Additionally, the Compensation Committee periodically reviews our incentive-compensation and equity-based plans, makes recommendations to the Board related to the same and administers the issuance of stock options and other awards under our stock plans.

Table of Contents